“The current model is not able to generate enough money to face the debts that the clubs assume”

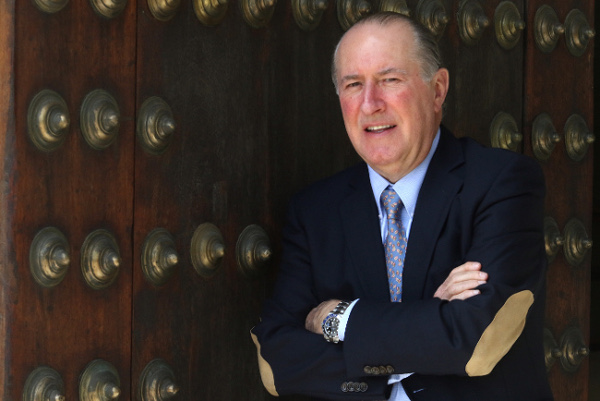

The football business, as it stands, is unsustainable. This is stated categorically by José María Gay de Liébana, full academician of the Royal European Academy of Doctors-Barcelona 1914 (RAED), in his study “Las finanzas de las cinco grandes ligas europeas (2015/16)” (The finances of the five major European leagues (2015/16)), which this year reaches its ninth edition. After a new detailed and updated study of the five main competitions of international football, the academician and professor of Economics and Business at the University of Barcelona concludes that despite legal reforms and the competitiveness of leagues and clubs, the sector can not to face with its own resources the inflation that involves the intrusion of external agents, such as the injection of Qatarian capital in the French PSG, or face a chronic debt.

“It can be argued that the football business itself is not in a position to generate enough money for itself to be able to cancel the debts that some clubs assume because of great signings -says Gay de Liébana-. The football market, since August 2017, has soared to unimaginable levels. Neymar’s signing, or payment of his termination clause, is followed by a chain of player transactions whose figures, we believe, swell a tremendous bubble football, so that the assets of the clubs or, at least, some of them, begin to take on exuberant dimensions”, he reflects.

Knowing the football market, the academician reviews, balances in hand, the situation of competitions and clubs, which rise as paradigms of the economy of each of their countries. “In the balance of each of these leagues is embedded the economic imprint of their respective countries, from British greatness to theoretical German austerity, to the lively Latin idiosyncrasy embodied by our League and Italian Serie A and that know-how that distinguishes the French. Football is the lively reflection of a country’s economy”, concludes Gay de Liébana.

The situation of this last season maintains the line of the last ones, with the British soccer much ahead of its competitors. “The size of the Premier League is far superior to that of the other four leagues -says the academician-. With assets directly targeting 9,000 million euros, debts of more than 6.5 billion, equivalent to almost 74% total liabilities and equity or equity of more than 2.3 billion, accounting for 26% of global funding, the Premier is the first major European league and undoubtedly world-wide. More than twice that of LaLiga and more than three times that of the Bundesliga, the Spanish League, whose assets amounted to 4,017 million euros, with global debts of 3,002 million (75% of the financing) and a net worth of 1,015 million (25% of the total liabilities), is catapulted to the second place in the ranking”.

The situation of this last season maintains the line of the last ones, with the British soccer much ahead of its competitors. “The size of the Premier League is far superior to that of the other four leagues -says the academician-. With assets directly targeting 9,000 million euros, debts of more than 6.5 billion, equivalent to almost 74% total liabilities and equity or equity of more than 2.3 billion, accounting for 26% of global funding, the Premier is the first major European league and undoubtedly world-wide. More than twice that of LaLiga and more than three times that of the Bundesliga, the Spanish League, whose assets amounted to 4,017 million euros, with global debts of 3,002 million (75% of the financing) and a net worth of 1,015 million (25% of the total liabilities), is catapulted to the second place in the ranking”.

In the specific analysis of the Spanish competition, Gay de Liébana shows a slight optimism within the sensation of general bankruptcy. Only two clubs, he explains, are facing a state of insolvency patrimonial, unlike previous seasons. They are the Deportivo of La Coruña, which comes out of a bankruptcy process, and Getafe, whom the promotion to First Division must allow to survive. “In view of the synthetic balances of our clubs in the 2015/16 season, we can say that the strong sanitation process that has been taking place in Spanish football for a long time is bearing fruit, and the solidity of assets and financial stability are settling, although it is true that there is still a long way to go in such matters -he said-. Our League continues to suffer, despite the recovery detected in its financial aspect, of excessive short-term debt compared to the volume of its current assets. A serious problem that was derived not long ago in an avalanche of insolvencies filed before the courts by several clubs of the First and Second Divisions”.